101face.ru News

News

What Is Difference Between Roth And 401k

:max_bytes(150000):strip_icc()/Roth401KFinal-5a3c1d320b4444fabce2fc0d3cf8cbf0.png)

Regular (k) and (b) retirement plans are funded with pre-tax dollars. Roth plan contributions are made with after-tax dollars. Understanding contribution. The Plan website has a handy estimator that allows you to compare how various contributions could affect your take-home pay today and your retirement savings in. The main differences between the two types of Roth accounts come down to contribution limits, income limits, and RMD rules (for tax years and before). IRA. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay no taxes on qualifying distributions when the money is withdrawn. Roth IRA contributions are made with after-tax dollars. Traditional, pre-tax employee elective contributions are made with before-tax dollars. No income. May be rolled over directly to a Roth IRA with no tax payment. Roth vs. Traditional (k)s: A Quick Comparison. The table below presents a summary of some of. Both Roth (k)s and Roth IRAs require after-tax contributions. This is a significant difference from the pre-tax contributions investors typically make to With a Roth (k), your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement. Traditional. The tax treatment of after-tax contributions comes with a catch. Unlike with Roth contributions, your withdrawals during retirement aren't completely tax-free. Regular (k) and (b) retirement plans are funded with pre-tax dollars. Roth plan contributions are made with after-tax dollars. Understanding contribution. The Plan website has a handy estimator that allows you to compare how various contributions could affect your take-home pay today and your retirement savings in. The main differences between the two types of Roth accounts come down to contribution limits, income limits, and RMD rules (for tax years and before). IRA. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay no taxes on qualifying distributions when the money is withdrawn. Roth IRA contributions are made with after-tax dollars. Traditional, pre-tax employee elective contributions are made with before-tax dollars. No income. May be rolled over directly to a Roth IRA with no tax payment. Roth vs. Traditional (k)s: A Quick Comparison. The table below presents a summary of some of. Both Roth (k)s and Roth IRAs require after-tax contributions. This is a significant difference from the pre-tax contributions investors typically make to With a Roth (k), your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement. Traditional. The tax treatment of after-tax contributions comes with a catch. Unlike with Roth contributions, your withdrawals during retirement aren't completely tax-free.

Roth (k) contributions allow you to contribute to your (k) account on an after-tax basis and pay no taxes on qualifying distributions when the money is. Assuming you pay 24% in taxes, a traditional (k) will leave you with $2,,, to spend in retirement versus the $2,, tax-free in a Roth. This. The key difference between a traditional and a Roth account is taxes. With a traditional account, your contributions are generally pre-tax ((k)) but tax. A big difference in (k) vs. Roth IRA is the contribution amount. Also, (k) contributions are tax-deductible; Roth IRA deposits aren't but withdrawals. Another difference between a (k) or traditional IRA and a Roth IRA is that you're not required to withdraw money from a Roth after a certain age, whereas you. One of the biggest differences between the Roth (k) and Roth IRA is their annual contribution limits. In , you can contribute up to $23, per year —. With a Roth (k), you'll pay income tax on your contributions but no tax when you withdraw funds from the account. However, there are several caveats to. Higher contribution limits: In , you can stash away up to $22, in a Roth (k)—$30, if you're age 50 or older. Roth IRA contributions, by. The Roth (k) allows you to contribute to your (k) account on an after-tax basis—and pay no taxes on qualifying distributions when the money is withdrawn. Roth (k) money grows tax-free Roth-designated (k) contributions are a discretionary feature in an employer-sponsored (k) plan. Unlike traditional The Roth allows post tax deductions from payroll and all growth and withdrawals will be tax free in retirement. Traditional is pre tax and all. Roth Comparison Chart, Comparison of Roth (k), Roth Roth IRA/Account Chart - Top Ten Differences Between A Roth IRA And A Designated Roth Account. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay no taxes on qualifying distributions when the money is withdrawn. A Roth (k) is a type of employer-sponsored retirement account. Many employers offer company (k)s that allow employees to defer some of their income into. Another key difference between the two retirement accounts is the income limits for contributions. With a Roth k, there are no income limits for. Just as with a traditional pretax (k). • You elect how much of your salary you wish to contribute. • Your combined contributions to a Roth (k) and a. Contributions to a Traditional (k) plan are made on a pre-tax basis, resulting in a lower tax bill and higher take-home pay. Use this calculator to compare. The Roth (k) is a type of retirement savings plan. It was authorized by the United States Congress under the Internal Revenue Code, section A. A Roth (k) is a type of workplace-sponsored retirement account in which you contribute after-tax dollars. That means your pay will be taxed, then. What's the Difference Between a Roth (K) and a Roth IRA? · Higher contribution limits. Roth (k) plans allow for larger after-tax savings. · No income limits.

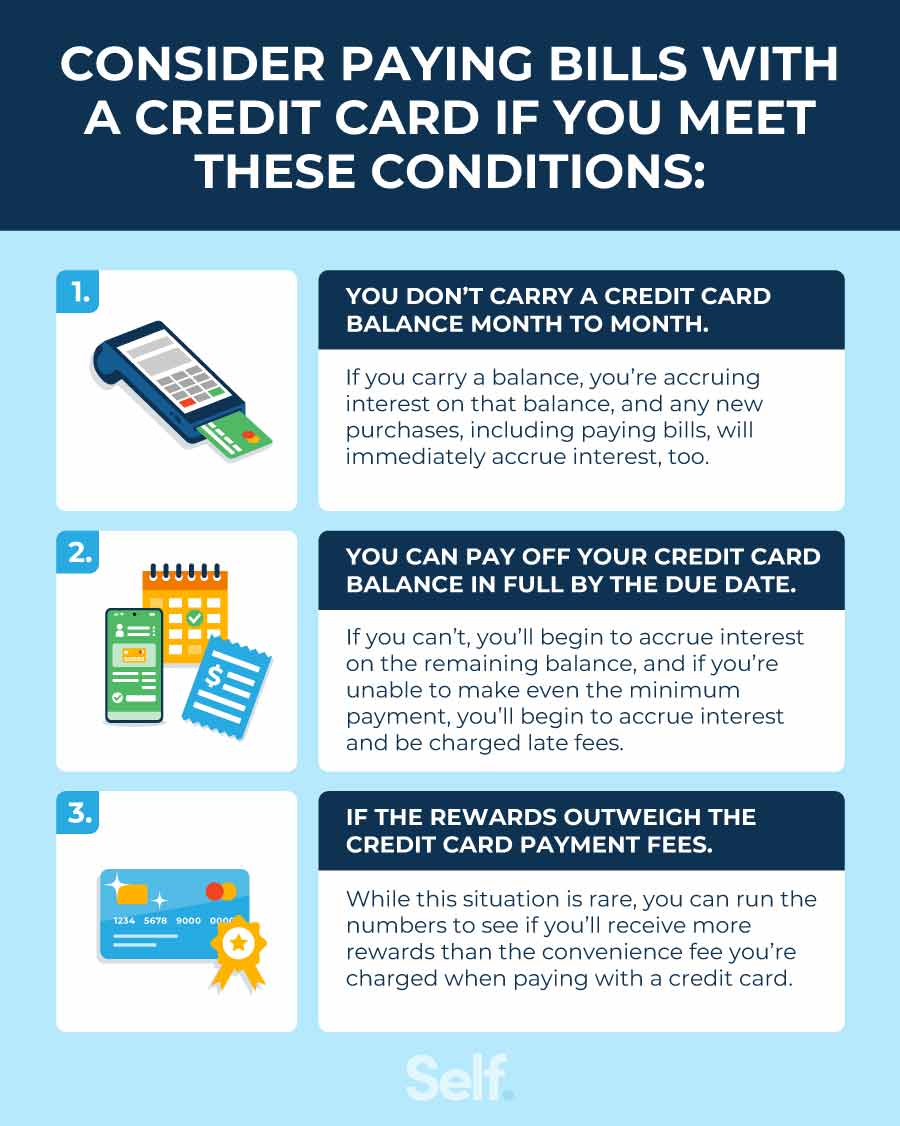

Can I Pay Credit With Credit

At the end of each monthly billing cycle, the card issuer will tell you how much you owe, the minimum payment it requires from you, and when that payment is. Services, utilities, and taxes can often be paid with a credit card but with a processing fee. Loan payments are usually check or bank withdrawal payments only. The short answer is no. Credit card companies don't allow you to make minimum monthly payments, or to pay off an outstanding balance, with another credit card. Use credit payments to delay cash outflow, extend Days Payable and Do you accept credit cards already? Yes, No. website. annual revenue. request a demo. A credit card can help you build credit 1, make convenient payments and meet everyday expenses in your life. Make your tax payments by credit or debit card. You can pay online, by phone or by mobile device no matter how you file. Learn your options and fees that. Not only will debt consolidation help you better organize your monthly payments, but it may allow you to pay less in interest. Here are a few ways to combine. You can use your credit card to make tax payments due with your tax or fee returns and prepayment forms. You may also make your billing payments and audit. You can arrange to have the monthly Minimum Payment or the balance in full automatically debited from your deposit account to pay your TD Credit Card. At the end of each monthly billing cycle, the card issuer will tell you how much you owe, the minimum payment it requires from you, and when that payment is. Services, utilities, and taxes can often be paid with a credit card but with a processing fee. Loan payments are usually check or bank withdrawal payments only. The short answer is no. Credit card companies don't allow you to make minimum monthly payments, or to pay off an outstanding balance, with another credit card. Use credit payments to delay cash outflow, extend Days Payable and Do you accept credit cards already? Yes, No. website. annual revenue. request a demo. A credit card can help you build credit 1, make convenient payments and meet everyday expenses in your life. Make your tax payments by credit or debit card. You can pay online, by phone or by mobile device no matter how you file. Learn your options and fees that. Not only will debt consolidation help you better organize your monthly payments, but it may allow you to pay less in interest. Here are a few ways to combine. You can use your credit card to make tax payments due with your tax or fee returns and prepayment forms. You may also make your billing payments and audit. You can arrange to have the monthly Minimum Payment or the balance in full automatically debited from your deposit account to pay your TD Credit Card.

Paying your credit card bill from another credit card is generally not recommended, as it can lead to additional fees, higher interest charges, and potentially. Pay your National Bank credit card balance instantly with the Transfer between accounts feature. From your web browser: Find out how to pay your credit card in. Taking advantage of a low-interest or no-interest balance transfer credit card offer can be a great way to reduce your debt, but be sure you do the math before. When you use a credit card, you are borrowing money from your bank, and if you pay it back consistently at the end of each month, your credit score will go up. Can I make a payment for my loan using a credit card? Unfortunately, we do not accept credit card for regular monthly or bi-weekly payments. Can I pay for multiple procedures at one time with my CareCredit health and wellness credit card? Does my CareCredit credit card expire? How do I use CareCredit. Setting up automatic payments is one way to keep up with your payments. You can do this from the Transfers tab using the app.* You can also change your payment. What happens if I cannot pay credit card bills? · Your lender will contact you by email, letter, text or phone · They will ask you to pay what you owe · Your. We eliminated fees and built tools to help you pay less interest, and you can apply in minutes to see if you are approved with no impact to your credit score. Bank attachment payments; Wage garnishment payments. What credit/debit cards can I use to pay my taxes? You can use. It's best to pay as much as you can each month. Any amount will help to reduce the amount of compounded interest you'll end up paying. Can help reduce your overall credit utilization, Paying bimonthly may be harder to keep track of ; Useful if need to build your credit score to be as high as. Use your CareCredit credit card to pay outstanding healthcare bills online. Whether it's a recent visit to the dentist, your pet's vaccinations or your sister's. When it comes to managing credit card and unsecured personal loan debt, it's good to be proactive. Paying even a small amount above the minimum payment. Can help reduce your overall credit utilization, Paying bimonthly may be harder to keep track of ; Useful if need to build your credit score to be as high as. A credit card or other type of loan known as open-end credit, adjusts the available credit within your credit limit when you make payment on your account. With 'Click to Pay' option, you can now use internet banking linked with accounts from other banks to pay the bill on your ICICI Bank Credit Card. The payment. Special Financing Offers No interest if paid in full within 6 months on purchases of $ or more made with your Dell Pay Credit Account. Interest will be. You can pay your credit card in any of several convenient ways. On our website: Log in to Online Banking and select the Bill Pay tab, then follow the. Pay your bill every month, even if the minimum payment is all you can afford. Missing a payment could result in a late fee, penalty interest rates and a.

South African Stock Markets

Up-to-date data on the stock market in South Africa, including leading stocks, large and small cap stocks. The African Securities Exchanges Association is the Premier Association of 27 Securities Exchanges in Africa, that have come together with the aim of. Johannesburg Stock Exchange (JSE) is South Africa's only full-service securities exchange, connecting buyers and sellers in five different financial markets. South Africa - Indices ; South Africa Top 06/09 |JTOPI. 73, ; FTSE South Africa. 06/09 |FTWIZAFL. 4, ; FTSE/JSE All. The main stock market index in South Africa (SAALL) increased points or % since the beginning of , according to trading on a contract for. The Johannesburg Stock Exchange is open Monday through Friday from am to pm South Africa Standard Time (GMT+). JSE Limited is the largest stock exchange in Africa. It is located in Sandton, Johannesburg, South Africa, after it moved from downtown Johannesburg in South Africa's business sector, the political economy, companies and financial markets Stock Picks. Business Day TV speaks to Ricus Reeders from PSG. The Johannesburg Stock Exchange (JSE) remains Africa's largest and most liquid stock exchange with USD 1 m traded daily. The second-largest and most liquid. Up-to-date data on the stock market in South Africa, including leading stocks, large and small cap stocks. The African Securities Exchanges Association is the Premier Association of 27 Securities Exchanges in Africa, that have come together with the aim of. Johannesburg Stock Exchange (JSE) is South Africa's only full-service securities exchange, connecting buyers and sellers in five different financial markets. South Africa - Indices ; South Africa Top 06/09 |JTOPI. 73, ; FTSE South Africa. 06/09 |FTWIZAFL. 4, ; FTSE/JSE All. The main stock market index in South Africa (SAALL) increased points or % since the beginning of , according to trading on a contract for. The Johannesburg Stock Exchange is open Monday through Friday from am to pm South Africa Standard Time (GMT+). JSE Limited is the largest stock exchange in Africa. It is located in Sandton, Johannesburg, South Africa, after it moved from downtown Johannesburg in South Africa's business sector, the political economy, companies and financial markets Stock Picks. Business Day TV speaks to Ricus Reeders from PSG. The Johannesburg Stock Exchange (JSE) remains Africa's largest and most liquid stock exchange with USD 1 m traded daily. The second-largest and most liquid.

Sharenet provides financial information and services for investors on The JSE Securities Exchange and other South African markets including online share. Daily update of the South African market. From market news, valuation, and performance to stock trends, gainers, and losers. Business and finance news from across africa. Entreprenuers, small business, enterprise, public companies, earnings reports. Explore the JSE, the largest stock exchange in Africa. Founded in , the JSE is the 16th largest stock exchange by market cap. South Africa ; FTSE/JSE All Share · 81, ; FTSE/JSE Resource 20 · 52, ; JSE FTSE Top 40 · 73, ; JSE FTSE Mid Cap · 84, ; JSE FTSE Small Cap. This chart shows the cumulative weekly equity in country flows into or out of South Africa in USD. EPFR Global provides global coverage of foreign investor. The main Johannesburg stock exchange index to follow if you are interested in what the overall markets in South Africa are doing is the JSE All Share index. The Johannesburg Stock Exchange (JSE) offers secure, efficient primary and secondary capital markets across a diverse range of securities, supported by our post. Financial markets: A week of records · Equity markets, rand bounce back · Rand, JSE surge on signs of moderating inflation in US · A 'Textbook Turnaround. Investors can't get enough of South African local currency bonds. 3 Sep Asian stocks erase gains as dollar resumes rally: Markets wrap. 3 Sep. The JSE's Equity Market connects buyers and sellers interested in exposure to South African listed companies, dual listed companies from across the globe and a. The three new contenders, ZAR X, 4 Africa Exchange (4AX) and A2X Markets, have been granted exchange licences by the South African Financial Services Board (FSB). The Johannesburg Stock Exchange is open Monday through Friday from am to pm South Africa Standard Time (GMT+). Johannesburg Stock Exchange (JSE) - Listed Companies ; African Dawn Capital, ADW, Financial Services ; African Eagle Resources Plc, AEA, Industrial Metals &. A2X is a stock exchange playing an integral part in the progression of the South African marketplace. · With our proven track record backed by market statistics. Updated stock indexes in Europe, Middle East & Africa. Get an overview of major indexes, current values and stock market data in Europe, UK, Germany. Stock market return (%, year-on-year) in South Africa was reported at % in , according to the World Bank collection of development indicators. Market Indicators - Local ; JSE All Share Index · J · · ; JSE Top 40 Index · J · · ; FTSE/JSE Financials Index · JI · · A list of the listed companies on the Johannesburg Stock Exchange (JSE) with market cap, share price, sector information, latest news and more. JSE listed company information including daily prices, forecasts, SENS, news, financial results and earnings.

If Your House Burns Down What Does Insurance Cover

Home insurance policies usually include coverage for damage caused by a fire that originated on the property, a neighbouring property, or resulting from natural. Therefore, insurance will not cover someone if their insurance company can prove that the house was vacant when it caught fire. Many Florida home insurance. If your house burns down under an actual cash value policy, the insurance company will give you back the original cost of your property, minus depreciation. However, your policy likely excludes damage from fires that were intentionally set. Conclusion. Despite the popularity of smoking dwindling in recent decades. Renters insurance may cover fire damage to your belongings, up to the limits of your policy's personal property coverage and minus any deductible. Most policies include coverages that may help pay to repair or replace your home and its contents if they are damaged by fire. Your house is probably the most. The vast majority of homeowners insurance policies cover fire damage to your property and loss of personal belongings, as well as covering the expenses for. Fire damage is covered under home insurance - including forest fires. Learn how your coverage works and what to do if you've been impacted. Damage to vehicles from fire is usually covered under an automobile insurance policy if you have purchased comprehensive or all perils coverage. This coverage. Home insurance policies usually include coverage for damage caused by a fire that originated on the property, a neighbouring property, or resulting from natural. Therefore, insurance will not cover someone if their insurance company can prove that the house was vacant when it caught fire. Many Florida home insurance. If your house burns down under an actual cash value policy, the insurance company will give you back the original cost of your property, minus depreciation. However, your policy likely excludes damage from fires that were intentionally set. Conclusion. Despite the popularity of smoking dwindling in recent decades. Renters insurance may cover fire damage to your belongings, up to the limits of your policy's personal property coverage and minus any deductible. Most policies include coverages that may help pay to repair or replace your home and its contents if they are damaged by fire. Your house is probably the most. The vast majority of homeowners insurance policies cover fire damage to your property and loss of personal belongings, as well as covering the expenses for. Fire damage is covered under home insurance - including forest fires. Learn how your coverage works and what to do if you've been impacted. Damage to vehicles from fire is usually covered under an automobile insurance policy if you have purchased comprehensive or all perils coverage. This coverage.

If you were forced to evacuate your home, you might not have grabbed basic necessities—from a toothbrush to a work uniform. Your homeowners' policy will cover. Your car would be covered under comprehensive coverage from your personal auto insurance coverage, which covers situations other than an accident such as. Landlord/Owner's Insurer. As a property owner, you are responsible for fire damage related to the structure of the building. Your landlord insurance policy. Roof: Your roof should be inspected for damage from burning embers. · Structural Steel, Iron: Steel and iron structures may transfer heat and destabilize a. In most cases, home insurance would cover at least part of the cost to repair your home. It would also cover the cost of temporary housing if your house is. When a house gets burned down, how much proof do you have to show the homeowners insurance company when making a claim for all of your lost. Most personal property insurance policies (homeowner, condominium unit owner and tenant) cover the cost of alternate accommodations and living expenses for. If you were forced to evacuate your home, you might not have grabbed basic necessities—from a toothbrush to a work uniform. Your homeowners' policy will cover. A house fire could damage or destroy your personal belongings. The amount of reimbursement you receive from your insurance company depends on the type of. It pays to repair, replace, and rebuild your property after a fire. It also covers any personal belongings damaged by fire. Most policies include fire. Basic home insurance policies have coverage for loss or damage caused by lightning, hail, wind and forest fires. For example, if a windstorm damages the. Most business insurance policies cover fire damage, too. If residents have to leave their homes because of a mandatory evacuation order issued by civil. A house fire could damage or destroy your personal belongings. The amount of reimbursement you receive from your insurance company depends on the type of. Homeowner's and auto insurance DO NOT work the same. The home should be insured for the cost to rebuild. Not the mortgage amount. Not the market. If you are the property owner/landlord, the insurance only covers the property itself. It does not cover neighbours' or tenants' personal belongings or if items. Typically, your homeowner's insurance covers accidental fires in and around your home. Learn more on fire damage and home insurance. This is very important because if you have too little coverage, you may not have enough to rebuild. FAR too little and you may even face an additional penalty. Recover your possessions. Items destroyed in a house fire may be covered by insurance. Typically, the homeowners policy is a replacement cost policy. When. If the smoke came from the fire and damaged your belongings, they, too, can be covered under your home insurance. How much does a homeowners insurance claim for.

Agavos Tequila Extra Anejo

Alma De Agave Añejo is the perfect delight for the vintage tequila lover. It is matured in oak barrels for eighteen months (twice the required regulated norm). Don Vicente Extra Añejo - Named the "World's Best Tequila" by the Tasting Alliance World Championship, the biggest spirits competition on Earth How did we do. Tears Of Llorona Extra Añejo No. 3 tequila is aged for over five years in Cognac casks, Sherry casks, and Scotch barrels. This tequila is allocated. tequila is made, an exploration of the agave fields of Jalisco, and a drinker's guide to the four types of tequila: blanco, reposado, añejo, and extra añejo. José Cuervo Extra Añejo Atelier Del Maestro Tequila. Maestro Dobel. Extra Anejo 75cl. US$ MX$3, Buy any 3 x 2. Add to Wish List Add to Compare. Plus how to store tequila properly (and drink tequila that's aged). Many Casa Mexico Tequila fans have asked us about the shelf life of their unopened bottle. Powerful, intense flavor leaving a stream of herbs and spices on the tongue. Subtle whispers of white oak in the finish. Agave 99® is an overproof tequila. Real Tequila · Comprar por tipo · TEQUILA BLANCO · TEQUILA REPOSADO · TEQUILA AÑEJO · TEQUILA EXTRA AÑEJO · MEZCAL · solo los mejores. Aged in-barrel, our Tequila Añejo takes on smoky sweet caramel and butterscotch flavors, floral tones, and hints of rosemary spice to mature into the Organic. Alma De Agave Añejo is the perfect delight for the vintage tequila lover. It is matured in oak barrels for eighteen months (twice the required regulated norm). Don Vicente Extra Añejo - Named the "World's Best Tequila" by the Tasting Alliance World Championship, the biggest spirits competition on Earth How did we do. Tears Of Llorona Extra Añejo No. 3 tequila is aged for over five years in Cognac casks, Sherry casks, and Scotch barrels. This tequila is allocated. tequila is made, an exploration of the agave fields of Jalisco, and a drinker's guide to the four types of tequila: blanco, reposado, añejo, and extra añejo. José Cuervo Extra Añejo Atelier Del Maestro Tequila. Maestro Dobel. Extra Anejo 75cl. US$ MX$3, Buy any 3 x 2. Add to Wish List Add to Compare. Plus how to store tequila properly (and drink tequila that's aged). Many Casa Mexico Tequila fans have asked us about the shelf life of their unopened bottle. Powerful, intense flavor leaving a stream of herbs and spices on the tongue. Subtle whispers of white oak in the finish. Agave 99® is an overproof tequila. Real Tequila · Comprar por tipo · TEQUILA BLANCO · TEQUILA REPOSADO · TEQUILA AÑEJO · TEQUILA EXTRA AÑEJO · MEZCAL · solo los mejores. Aged in-barrel, our Tequila Añejo takes on smoky sweet caramel and butterscotch flavors, floral tones, and hints of rosemary spice to mature into the Organic.

I ended up buying one bottle of Extra Añejo tequila and my family ended up purchasing 2 bottles of blanco. Agavos, and Isla Cuzamil). If you google. Tequila Extra Anejo "Regalo de Dios". I got this organic tequila in Mexico back in December. Very difficult to find much info on it;. --Extra Anejo/Ultra Aged, --Gold Tequila, --Mezcal, --Mixto, --Reposado, --Blanco A blend of % blue agave tequila, infused with the essence of oranges and. tequila. You can get jaded even by the best brands if you drink too much. Nonetheless, if taken with moderation, i would go for Patron Anejo. Distilled twice in copper stills and aged for 37 months in used, charred American oak barrels, this tequila has a refined aroma and a soft, delicate taste. Clases: Tequila Blanco o plata,; Joven u oro,; Tequila reposado; Tequila añejo; Tequila extra añejo. See full transcript. I'm telling you, this is the best tequila I've ever had in my life. There's this extra anejo version that they have that is smooth like water. I probably. Agave Trails Anejo Tequila is a premium tequila that has been aged for a minimum of 18 months in oak barrels, resulting in a smooth and complex flavor profile. Handcrafted, estate grown agave farmed by hand. Ultra-Premium. Always Smooth. Avila(R). Tequila Aficionado's Gold Medal Winner. Find the best local price for Fuenteseca Reserva 18 Year Old Tequila Extra Anejo, Jalisco, Mexico. Avg Price (ex-tax) $ / ml. It is painfully sweet. It seriously tastes like agave nectar with a bit of tequila in it. If you like a very sweet tequila this one is for you. AMBHAR Añejo is a delicately aged tequila, resting in premium whiskey oak barrels for over two years. The extended amount of aging produces its dark amber. Find the best local price for Fuenteseca Reserva 18 Year Old Tequila Extra Anejo, Jalisco, Mexico. Avg Price (ex-tax) $ / ml. Alma De Agave Tequila (1); Azuñia Tequila (1); Bacardi (2) Adictivo Extra Anejo Tequila. Tequila | Mexico | mL. $ Add. Mascota Tequila Reposado ml THE LITTLE TEQUILA BRAND THAT HAS CAPTURED THE HEARTS OF PEOPLE AROUND THE WORLD!Mascota Tequila, aka The Doggy Tequila™ is a. Tequila Cascahuin Anejo (40% abv) $ % Agave is aged in spent American oak barrels used for tequila for more than 20 years, the maturation or aging. ADD $6 for each shot of our Premium Tequilas in a flight: Don Julio Añejo; Patron El Cielo Silver; Clase Azul Reposado. Explore our premium tequila selection at LCBO: From smooth reposados to bold añejos, find your perfect agave spirit. Shop now for a taste of Mexico. Deleite Extra Anejo tequila has been aged 36 months or more in oak and is some of the most rare and sought after tequila in the world. Learn to drink tequila like a local, discover the difference between Blanco, Reposado, Anejo, and Extra Anejo, and savor free tequila shots in a picturesque.

Are Mustangs Expensive To Insure

The average cost of Ford Mustang insurance is $ per month for full coverage and $98 for state minimum coverage– but individual quotes can vary greatly. 22 year old single male in Los Angeles driving an E9xM3 or Ford Mustang Tell us what you get for insurance quotes. It can't be less than $ per year and. The price you pay to insure your Ford Mustang can vary based on your age group. Here are the average rates you can expect to pay. How much is a Ford Mustang? · How much does a Ford Mustang cost? UK prices · Is the Ford Mustang a good car? · Mustang maintenance costs · How much is insurance for. The cost would entirely depend on the year and trim level of the Mustang, desired coverage, set deductibles, your age and driving history, and. Here are some tips to consider that may help you lower the cost: Installing a car alarm or some other kind of anti-theft device. Using a different car for. Ford Mustang insurance costs range from $23 to $72 per month. Depending on your model year and coverage, Allied is the cheapest company. Mustang Coupe GT Premium 2dr Coupe w/Prod. End 4/24 (L 8cyl 6M) ; $1,, $1,, $1,, $1, ; $, $, $, $2, The typical annual insurance cost for a Ford Mustang is $1, The Mustang Ecoboost Convertible has a rate of $1, per year, while the Mustang Shelby. The average cost of Ford Mustang insurance is $ per month for full coverage and $98 for state minimum coverage– but individual quotes can vary greatly. 22 year old single male in Los Angeles driving an E9xM3 or Ford Mustang Tell us what you get for insurance quotes. It can't be less than $ per year and. The price you pay to insure your Ford Mustang can vary based on your age group. Here are the average rates you can expect to pay. How much is a Ford Mustang? · How much does a Ford Mustang cost? UK prices · Is the Ford Mustang a good car? · Mustang maintenance costs · How much is insurance for. The cost would entirely depend on the year and trim level of the Mustang, desired coverage, set deductibles, your age and driving history, and. Here are some tips to consider that may help you lower the cost: Installing a car alarm or some other kind of anti-theft device. Using a different car for. Ford Mustang insurance costs range from $23 to $72 per month. Depending on your model year and coverage, Allied is the cheapest company. Mustang Coupe GT Premium 2dr Coupe w/Prod. End 4/24 (L 8cyl 6M) ; $1,, $1,, $1,, $1, ; $, $, $, $2, The typical annual insurance cost for a Ford Mustang is $1, The Mustang Ecoboost Convertible has a rate of $1, per year, while the Mustang Shelby.

Relative to the industry averages on maintenance costs, no, it is not.

But, according to the Insurance Information Institute (III), the color of the car you drive does not affect the price of auto insurance. Here are some of the. The high cost and performance of luxury and exotic cars can lead to higher theft risks, crash rates, and repair costs, increasing their risk to insurers. Are. The components of TCO® are depreciation, interest on financing, taxes and fees, insurance premiums, fuel, maintenance, repairs and any federal tax credit that. Ford Mustang car insurance costs, on average, is $ annually for state-mandated minimum coverage; full coverage, which includes collision and comprehensive. Auto insurance for a Ford Mustang will cost about $2, per year. This beats the national average for popular coupe models by $ Our car insurance. Auto insurance for a Ford Mustang will cost about $2, per year. This beats the national average for popular coupe models by $ much fun as the Mustang (which runs on '87). And the STi's definitely going to have higher insurance rates WRXs will handle better, but mustangs can. How much is insurance for a mustang? The average driver pays up to $ per month or about $1, per year for full coverage. As this is. Your level of driving experience will be assessed when calculating your car insurance rate. Mustang drivers with years or even decades of experience behind the. Ford Mustang Insurance Cost List · Ford Mustang EcoBoost Insurance Price. RM 12, · Ford Mustang GT Insurance Price. RM 15, Average Cost To Insure A Ford Mustang Per Year. The average insurance cost of a Mustang is $ monthly or $2, yearly, however the average range is between. Ford Mustangs are classified as sports cars or muscle cars, increasing your insurance costs. To get an accurate idea of how much your Ford Mustang insurance. In general, Mustangs are more expensive to insure than other vehicles, but we understand that if you've got your heart set on buying a Mustang, you'll probably. But, according to the Insurance Information Institute (III), the color of the car you drive does not affect the price of auto insurance. Here are some of the. No matter which model you choose, Ford Mustang insurance will be on the more expensive side. cheaper to insure than the more dynamic litre V8 variants. Get The Best Classic Ford Mustang Insurance · Why Choose American Collectors Mustang Insurance · How Much Does It Cost to Insure a Classic Mustang? · Get a Free. Full coverage insurance on a Mustang costs about $ per month or $1, annually. But teens and other high-risk drivers will pay much more. Good drivers can. The high cost and performance of luxury and exotic cars can lead to higher theft risks, crash rates, and repair costs, increasing their risk to insurers. Are. Here are some tips to consider that may help you lower the cost: Installing a car alarm or some other kind of anti-theft device. Using a different car for. Mustang insurance, as expected, is more expensive than other Ford models, costing an average of $2, per year for full coverage. Full coverage policies range.

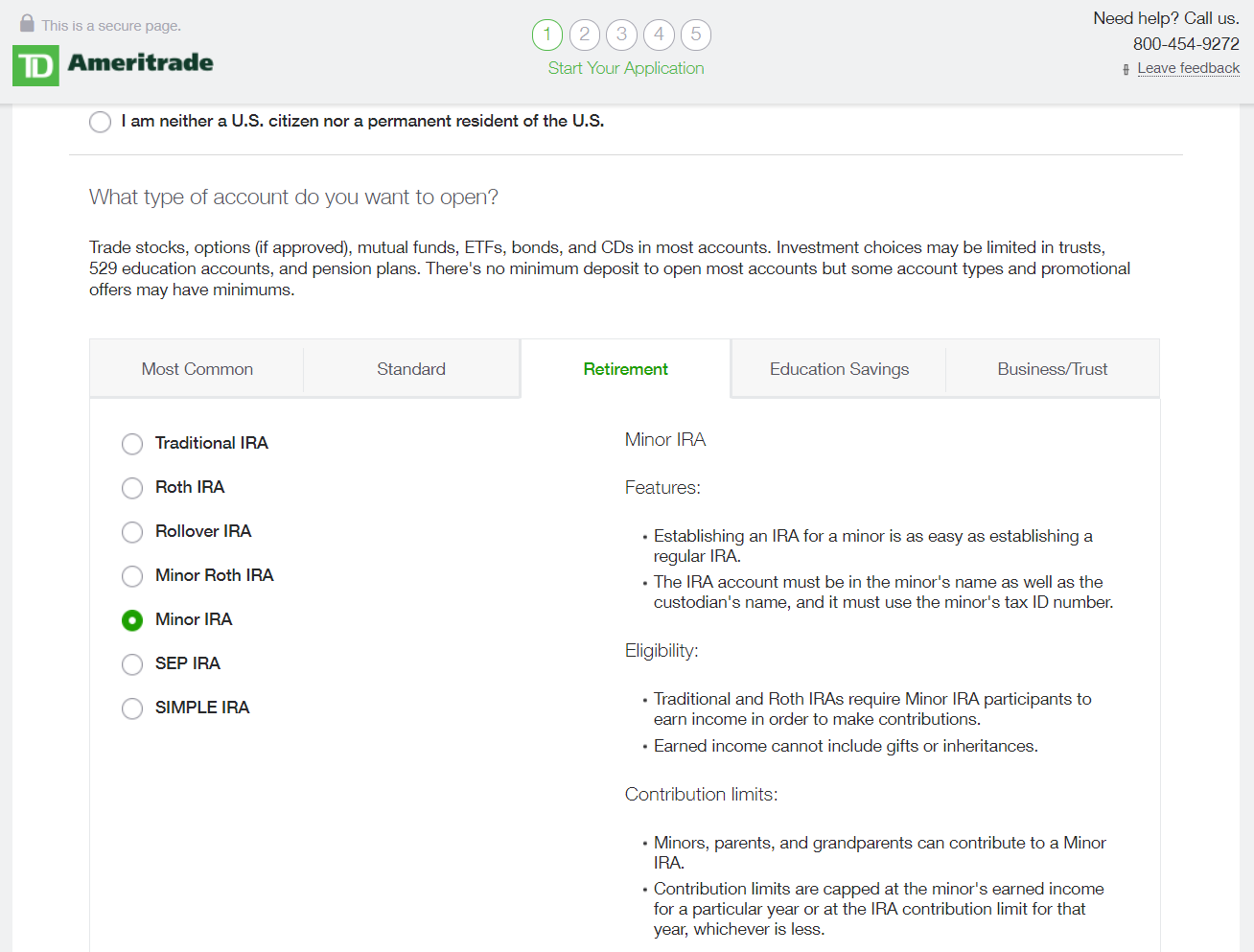

Open Td Ameritrade Account For Minor

A parent or relative can open an account on behalf of a child, and they act as the account custodian until the child comes of age. Depending on your state, the. As an alternative, we suggest a brokerage firm called Charles Schwab that offers UTMA/UGMA custodial accounts as well as $0 commission on stocks, ETFs and other. Under 18? Open a joint account in person Minors must visit a TD Bank store with a parent or legal guardian to open an account. Parents and legal guardians. Are you ready to open an account? Doing this online is simple, and we'll show you how to make an account contribution using cash or non-cash assets from. TD Ameritrade also supports UGMA/UTMA custodial accounts where you can invest and manage an account for your child until they reach the age of majority. You don. Are you ready to open an account? Doing this online is simple, and we'll show you how to make an account contribution using cash or non-cash assets from. The Schwab One Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. If you want to invest into stocks, you can invest with the help of a custodial account, which would be opened and managed by your legal guardian. This is a savings account for a minor that is controlled or supervised by an adult - usually a parent, guardian or grandparent. Accounts can be held at banks. A parent or relative can open an account on behalf of a child, and they act as the account custodian until the child comes of age. Depending on your state, the. As an alternative, we suggest a brokerage firm called Charles Schwab that offers UTMA/UGMA custodial accounts as well as $0 commission on stocks, ETFs and other. Under 18? Open a joint account in person Minors must visit a TD Bank store with a parent or legal guardian to open an account. Parents and legal guardians. Are you ready to open an account? Doing this online is simple, and we'll show you how to make an account contribution using cash or non-cash assets from. TD Ameritrade also supports UGMA/UTMA custodial accounts where you can invest and manage an account for your child until they reach the age of majority. You don. Are you ready to open an account? Doing this online is simple, and we'll show you how to make an account contribution using cash or non-cash assets from. The Schwab One Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. If you want to invest into stocks, you can invest with the help of a custodial account, which would be opened and managed by your legal guardian. This is a savings account for a minor that is controlled or supervised by an adult - usually a parent, guardian or grandparent. Accounts can be held at banks.

Fidelity's Roth IRA has no minimum investment to open an account and no annual fees. Since minors cannot legally open an account in their own name until they. account controlled by the adult until the child is no longer a minor. Once No minimum to open a TD Ameritrade brokerage account; minimum $25, Open a new M1 Finance account and initiate an account transfer within 60 Gift accounts for minors, including UTMAs and UGMAs; Specialty accounts. Unfortunately, you also need to be 18 to make a TDA account, so perhaps wait until you are older. Learn how to open a custodial account to invest on behalf of a minor Schwab Trading Powered by Ameritrade™ · thinkorswim® Trading Platforms · Overview. Under 18? Open a joint account in person Minors must visit a TD Bank store with a parent or legal guardian to open an account. Parents and legal guardians. Welcome to the Schwamily, TD Ameritrade colleagues! I'm excited to come together to help more Americans work toward financial security and. If you are under the age of 18, you must open a joint account with a parent or legal guardian as the secondary owner. For the TD Essential Banking account, the. 8 Plus, $0 minimum required to open an account. Learn more about a Savings Plan · Open a Account minor and help teach them about investing. There. Parents seeking a variety of accounts for their children. New Invest in stocks, fractional shares, and crypto all in one place. Open An Account. Under the laws that govern custodial accounts, including the Uniform Transfers to Minors Act (UTMA), account custodianship ends and the beneficiary becomes. Best Custodial Accounts for Kids · 1. Charles Schwab · 2. Fidelity · 3. TD Ameritrade · 4. Ally Bank · 5. UNest. A parent/guardian or any adult that opens the account has control of it until the child is years old at which time the assets belong to the adult for whom. Impax Funds also are available through many retail brokerage firms such as Charles Schwab, Fidelity Investments, E*TRADE, and TD Ameritrade. Can a minor open. TD Ameritrade account. Investment tools and resources. Access FREE online education, tools, and support-including valuable investment seminars, courses. Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Learn more · Open an account. Core Portfolios. Automated investment. Opening an account. This is accomplished by completing a single-page application on the TD Ameritrade website. Basic information will be required, including. 8 Plus, $0 minimum required to open an account. Learn more about a Savings Plan · Open a Account minor and help teach them about investing. There. Yes, you can open a trust account at TD Ameritrade, allowing a designated trustee to manage the account on behalf of a third party (eg a parent for minor-age. TD Ameritrade, %. Schwab, %. E*Trade, %. Does not take payment for Make your first investment today—open a Fidelity brokerage account in just.

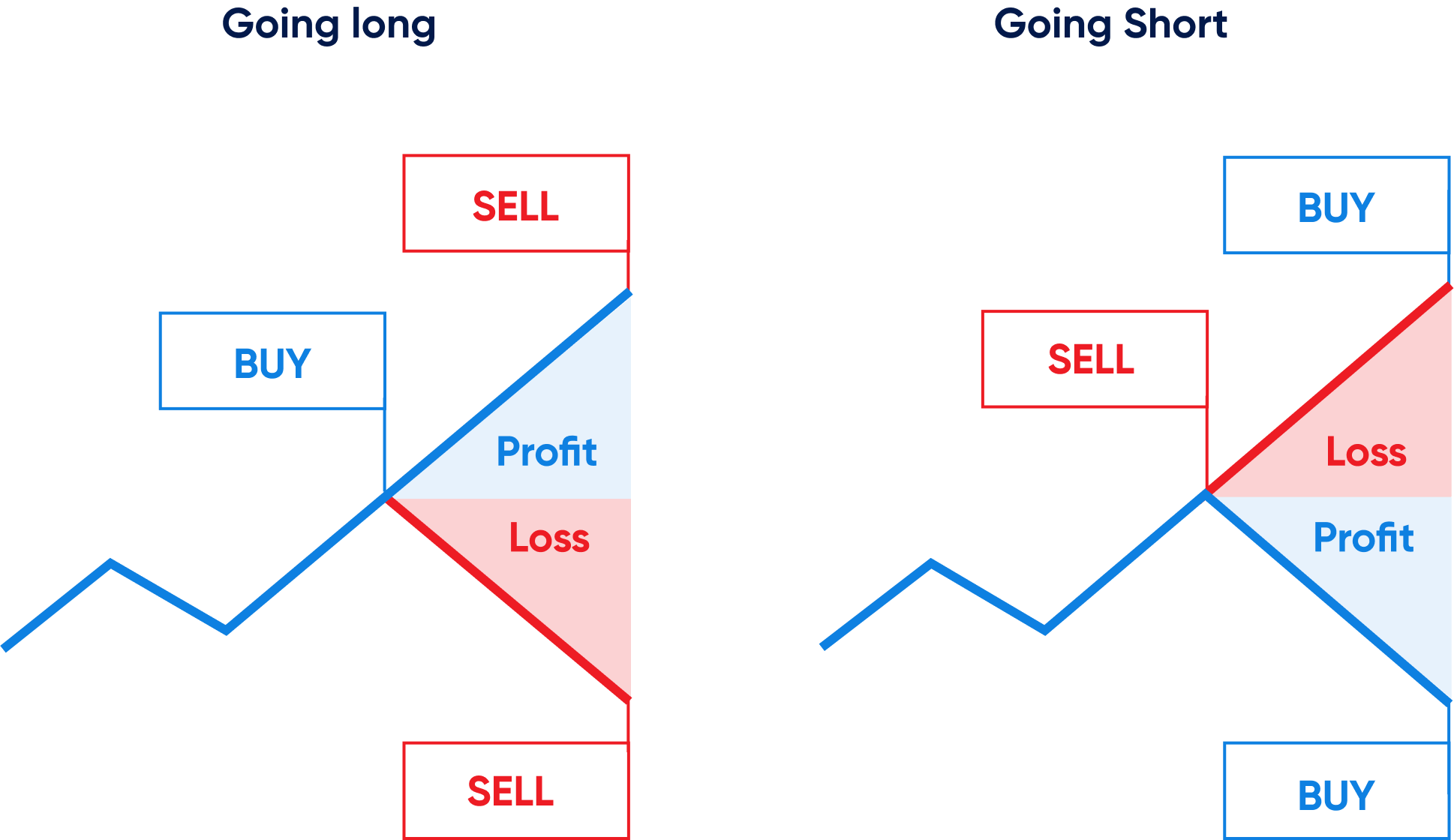

How To Find Trades

Looking for a reliable tradesperson? Read top tips for how to find a good tradesperson in your area, questions to ask them and how to choose. To find the status of your trade-in, review the status of your trade-in. Find out if an item is accepted or rejected. View rejection reasons where relevant. To be a successful day trader, you need to find the right stocks, identify a trend or pattern, and plan your entry and exit points. You can easily find out where your order to trade stands by checking your Order status. You can cancel a trade online, although we can't guarantee that the. Even seasoned traders can find buying and selling near the opening and And mutual funds typically wait to execute trades so they know how much cash. Looking for a reliable tradesperson? Read top tips for how to find a good tradesperson in your area, questions to ask them and how to choose. Not sure what trade is for you? Complete this quick quiz to see which trades you should explore based on your strengths and skills! Find the trades that'll take you to the playoffs. Customize the type of trade you're looking for, and we'll show you winning trades that your league-mates will. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Looking for a reliable tradesperson? Read top tips for how to find a good tradesperson in your area, questions to ask them and how to choose. To find the status of your trade-in, review the status of your trade-in. Find out if an item is accepted or rejected. View rejection reasons where relevant. To be a successful day trader, you need to find the right stocks, identify a trend or pattern, and plan your entry and exit points. You can easily find out where your order to trade stands by checking your Order status. You can cancel a trade online, although we can't guarantee that the. Even seasoned traders can find buying and selling near the opening and And mutual funds typically wait to execute trades so they know how much cash. Looking for a reliable tradesperson? Read top tips for how to find a good tradesperson in your area, questions to ask them and how to choose. Not sure what trade is for you? Complete this quick quiz to see which trades you should explore based on your strengths and skills! Find the trades that'll take you to the playoffs. Customize the type of trade you're looking for, and we'll show you winning trades that your league-mates will. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors.

Find out how to Veto or Protest a Trade. NOTE: The trade deadline for all standard leagues is Wednesday, November All trades must be accepted by that time. Benzinga analyzed a range of stocks & ETFs to determine the best for day trading, considering trade volume, price movement, newsworthiness, and market. trades in that same 5 trading day period. To verify in the app whether you're restricted from day trading or not on any given day, check your Day trade. Trade players with other teams just like real-life managers! Discover how to propose or respond to trade offers with other managers in your league. Explore trade profiles to learn about each of Alberta's designated trades. Find your Trade · verify · Check a Credential Online. Verify a person's. We've got the tools and platforms to help you tackle the markets on your terms, from virtually anywhere. Find out the one that's right for you. You can easily find out where your order to trade stands by checking your Order status. You can cancel a trade online, although we can't guarantee that the. Track US politician trades for free with Capitol Trades. Discover which Stocks/Assets/Companies/Issuers politicians are buying or selling. Check the trade-in value of your phone. Confirm eligibility, then shop devices and promotions. Enter a digit IMEI number. Trade forex online with the US top forex broker. Access over 80 currency pairs with spreads as low as pips. Trade FX on our award-winning trading. To confirm that a skilled trades professional or apprentice can legally work in a compulsory trade, enter: all or part of their first or last name, or; a. The general public cannot typically find out who is trading specific stocks unless the information is disclosed by the traders themselves or. Step 1: What Do You Need The Trade For? First of all, it is important to know what kind of trade you are looking for. There are multiple aspects to consider. If you still can't find a trader, you can check if there's a trade association for the type of company - for example the Retail Motor Industry Federation for. For example, a day trader may look for specific patterns that occur at certain times of the day. They may enter a trade when technical indicators reach certain. Find a Branch; Contact Us. Call. Schwab Brokerage. Schwab Password Popular in trading. Trading. What to Watch as You Trade. To participate. Viewing Your Current or Past Trades · In the left-hand menu of any page, click the Trade option to go to the Trade page. · Select the list of pending (Inbound/. To view the search criteria form and the parameters previously selected, click on the Show Search Criteria hyperlink located just below the Transaction Viewer. What to look for in a day trading platform. Between mobile apps, website platforms and downloadable desktop platforms, many brokers offer four or more different. SkilledTradesBC manages nearly 90 trades programs in BC, 48 of which are Red Seal. Browse or search for programs on this page.

Day Trade On Margin

Margin is a loan against the capital in your trading account. When using margin, the brokerage is loaning you the additional funds needed above your capital. Cash accounts appeal to conservative investors who wish to avoid trading with borrowed money. · Margin accounts allow for more leverage, which can magnify both. Day trading refers to a trading strategy where an individual buys and sells (or sells and buys) the same security in a margin account on the same day in an. End-of-day and day trading margins are explained. Day trading margins are offered as low as $ on select markets. Your margin deposit is a percentage of the full position size, and the margin rate is determined by your trading provider. Markets with higher volatility or. This minimum equity requirement applies to any day when you engage in day trading activities. It is important to note that the $25, minimum equity must be. Day-trading rules prohibit US-regulated brokers from providing margin greater than (ie, a multiple of four times your money) for any single trading day. This rule only applies to margin accounts and IRA limited margin accounts. If your account is flagged for PDT, you're required to have a portfolio value of at. Day trading on margin refers to the practice of buying and selling the same stocks multiple times within the same trading day. Margin is a loan against the capital in your trading account. When using margin, the brokerage is loaning you the additional funds needed above your capital. Cash accounts appeal to conservative investors who wish to avoid trading with borrowed money. · Margin accounts allow for more leverage, which can magnify both. Day trading refers to a trading strategy where an individual buys and sells (or sells and buys) the same security in a margin account on the same day in an. End-of-day and day trading margins are explained. Day trading margins are offered as low as $ on select markets. Your margin deposit is a percentage of the full position size, and the margin rate is determined by your trading provider. Markets with higher volatility or. This minimum equity requirement applies to any day when you engage in day trading activities. It is important to note that the $25, minimum equity must be. Day-trading rules prohibit US-regulated brokers from providing margin greater than (ie, a multiple of four times your money) for any single trading day. This rule only applies to margin accounts and IRA limited margin accounts. If your account is flagged for PDT, you're required to have a portfolio value of at. Day trading on margin refers to the practice of buying and selling the same stocks multiple times within the same trading day.

If you have completed at least 4-day trades within a 5-business-day period, your account will receive the Pattern Day Trader (PDT) designation. A margin trading account allows you to borrow funds to trade securities in the secondary equity, options, and futures markets. This percentage represents the amount of buying power you have to set aside when borrowing to trade. For example, if stock ABC has a 30% margin requirement you. To trade on margin, you need a margin account. This is different from a Interest is calculated on a daily basis and posted to your account each month. FINRA rules define a pattern day trader as any customer who executes four or more “day trades” within five business days, provided that the number of day. This rule only applies to margin accounts and IRA limited margin accounts. If your account is flagged for PDT, you're required to have a portfolio value of at. Pattern day traders must adhere to specific margin requirements, notably maintaining a minimum equity of $25, in their trading account before engaging in day. Are margin accounts more viable to established day traders opposed to newer investors (who can't afford to risk their smaller account sizes)? Pattern Day Traders: Based on FINRA day trading rules, any client that places four day trades in a five-trading-day period is deemed to be a “pattern day trader. Pattern Day Trader: someone who effects 4 or more Day Trades within a 5 business day period. A trader who executes 4 or more day trades in this time is deemed. A day trade call is generated whenever you place opening trades that exceed your account's day trade buying power and then close those positions on the same day. The PDT does not apply to cash accounts. If a trader with a cash account has the capital to support this, they can make hundreds of trades on a given day. The. The day-trading buying power for non-equity securities may be computed using the applicable special maintenance margin requirements pursuant to other provisions. A day trade is defined as opening and closing the same position on the same day. Margin accounts are allowed to have 3 day trades take place in a rolling 5. (1). Definition of “pattern day trader”. “Pattern day traders” are defined as those customers who day trade four or more times in five business days. If day. A pattern day trader (PDT) is a regulatory designation for traders who execute four or more day trades over a five-business-day period in a margin account. ¹Standard Day Trade Margin is offered to most clients with futures trading experience and is available during any open session as long as a $ balance is. Once your margin account is identified as a pattern day trader, regulations subject it to a minimum equity requirement of $25, If the account does not have. What are the rules for day trading? · You can lose more funds than you deposit in the margin account. · We can force the sale of securities in your account(s). Margin Day Trading. You could get started with less than a thousand dollars a week, so you could start with less than a thousand dollars in your account. Now.

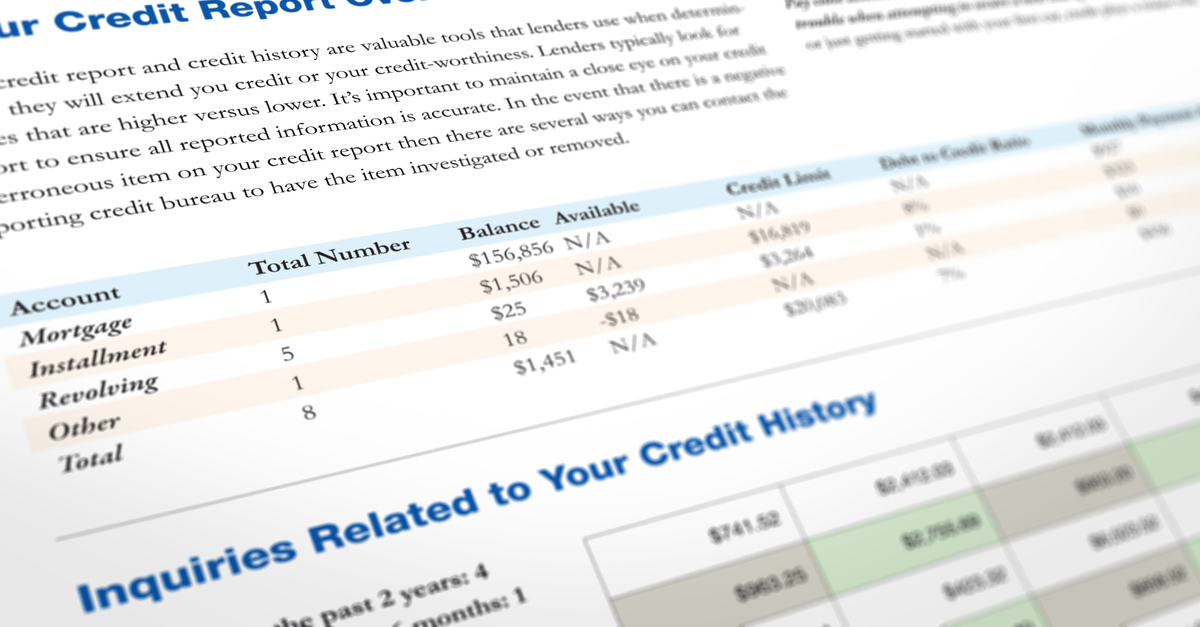

Accounts With Negative Information

Negative accounts display information about accounts for which payments have been missed. As with accounts in good standing, make certain that all information. In general, people who already have a good or excellent credit score may experience a larger score drop from negative information than someone who has a bad. Look for errors like wrong accounts, incorrect balances, or late payments you didn't miss. To dispute, write to the credit bureau with details and proof. Your bank account information doesn't show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking. If there is negative information on your credit report that is accurate, you can still try to have it removed. Contact the creditor and see if. Your FICO Scores consider both positive and negative information in your credit report. FICO Scores will consider your mix of credit cards, retail accounts. As long as the information is correct, a credit bureau can report most negative information for seven years, and bankruptcy information for 10 years. "Negative credit report" means information reflecting on the credit history of a party that, because of the party's past delinquencies, late or irregular. Find out how long credit reporting agencies can report negative items on your credit report. · Credit Accounts · Repossessions and Foreclosures · Medical Debts. Negative accounts display information about accounts for which payments have been missed. As with accounts in good standing, make certain that all information. In general, people who already have a good or excellent credit score may experience a larger score drop from negative information than someone who has a bad. Look for errors like wrong accounts, incorrect balances, or late payments you didn't miss. To dispute, write to the credit bureau with details and proof. Your bank account information doesn't show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking. If there is negative information on your credit report that is accurate, you can still try to have it removed. Contact the creditor and see if. Your FICO Scores consider both positive and negative information in your credit report. FICO Scores will consider your mix of credit cards, retail accounts. As long as the information is correct, a credit bureau can report most negative information for seven years, and bankruptcy information for 10 years. "Negative credit report" means information reflecting on the credit history of a party that, because of the party's past delinquencies, late or irregular. Find out how long credit reporting agencies can report negative items on your credit report. · Credit Accounts · Repossessions and Foreclosures · Medical Debts.

In the United States, federal law requires that every piece of information on your credit reports be % accurate, verifiable, and timely. Derogatory or negative information can remain on your credit report for up to 10 years and create bad credit. It is a long time for a mistake(s) you made or. Negative information on your credit report can make a big impact on your financial well-being. It can disqualify you from obtaining home mortgages and car. The best way to address negative credit information provided on this site and accounts of a deceased customer held at Bank of America or its affiliates. Although most negative information stays on your credit report for seven years, there are exceptions you should be aware of. "Negative credit information" does not include information or credit histories arising from a nonconsumer transaction or any other credit transaction outside. Data management errors include accounts being listed more than once from several creditors. Another possibility is inaccurate information remaining on your. Not all creditors report information to credit bureaus, but most nationwide chain store and bank credit card accounts, along with loans, are included in credit. Negative information (e.g., late payments) remaining after the seven-year This tells creditors to contact you before changing your existing accounts or. Credit reporting agencies report information on each of your accounts separately for each creditor that holds or has held that account. Creditors refer to each. Even unfortunate situations like identity theft can appear as negative information, which affects your ability to get more credit and can hurt your credit score. adverse action is taken against you, such as lowering your credit limit on credit card account—because of information in your credit report, the lender. Credit reporting companies are only legally required to remove inaccurate negative information from your credit report after you have provided sufficient proof. Most positive account information can remain for up to ten years after the account is closed. negative credit accounts — including delinquent payments. That's because someone with a lower credit score already has their negative credit behavior reflected in their credit scores. information that's incomplete or. Companies collect information about your loans and credit cards. Negative information – do you recognize the accounts in this section of the report? Certain accounts or account information could have a negative impact. In order to maintain the quality of the credit reporting system, eCredable reports. An account in positive standing won't have any negative payment history. Negative information typically falls off your credit report 7 years after. If accounts do not contain adverse information, TransUnion normally reports the information for up to 10 years from the last activity on the account. Adverse.